Annnyhoooo, right before my bike trip (see previous blog post) I decided to go short on some "housing bubble" stocks: the home builders, the lenders, etc. This was my first time shorting, so I didn't risk very much, but every little bit counts, right? And one day housing prices will actually come down and I'll need to buy, so I'm trying to save all I can.

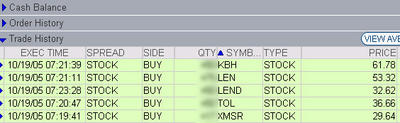

My original plan was to stay short on these for the duration (i.e. through the bubble deflation.) This morning though, at around 7:20a PT, while I was drinking my coffee, checking email, and reading the Philly Sport section, on a whim, I decided to cover five stocks. I really don't know why I did it. I guess there had been so many down days recently, and again the market was down (though moving up a little bit.) I was looking at an average of about 20% return on these investments if I covered, so I bought back my KBH, TOL, LEN, and LEND (I'm still short on FNM and my DSL). Oh, I also covered my XMSR which moved from 37 to 30 over the last 2 weeks or so, but I used this morning's dip load up on SIRI. (going long)

Later in the day, I saw that the entire housing sector had been downgraded, and I figured I'd made a mistake. But what's done is done -- shoulda-woulda-coulda.

Then suddenly, for no apparent reason, the market (housing stocks included) went bonkers. Look at these intradays:

TOL closed up 5%!

Why? Who knows... but for once in my life, I actually timed the market pretty well. Now of course, the question is, when to go short again? Oh yeah, these pigs are going down -- there's no doubt in my mind -- just look at how far off the yearly highs some of these stocks are -- but you gotta play the bounces, right? So we'll see what happens tomorrow and then roll the dice again. Six months from now, when FNM is at 25 and KBH is at 50, I don't wanna say shoulda-woulda-coulda, you know?

What stocks will I be shorting in the near future? I'd say

any of these are good candidates.

For more on the Bay Area Housing Crash, see patrick's links.

2 comments:

Nice one dude. Now only if you can figure out what caused the rise, and how you can get that info in advance, you can use that knowledge sometime in the future, lest this will hurt you sometime in the future.

Have fun gambling... :)

Post a Comment